So far so good. I am semi-on track for the second week in September and I am hoping that I'll be able to make the $300 expected. I am currently at $143, but Friday is one of the busiest nights so making at least $90 won't be difficult. The problem then lies in whether I'll get called in to work on Saturday or Thursday. I don't want to but the mocking glare of my budget says that it would be for the best. We shall see.

Either way, I have survived the bulk of the week and I am two classes and a TV show away from being done with school. Yay! However, for a Wednesday I am woefully off track on my personal expenses. On Sunday as I was riding home from a meeting I remembered the new sushi place located on campus just opened, so I decided to grab a menu. Big mistake, a $15 mistake. The food was good but mini portions, I doubt I'd go back. Then on Tuesday I had a lunch date (platonic, for now...) at a restaurant I used to work at, and that was another $15. So in the span of two days, I use up all but $5 of my expenses. Shame on me.

One bright spot though is at work tonight I was talking to a customer about a small grocery store on campus, and she asked me how I liked it, and I told her I thought it was too expensive. When I came back to the table she told me she owned the place and she gave me $5 gift certificate. I may use that tomorrow.

It seems like every financial blogger has 'frugal' tips on their site so I've decided to try and find some ideas of my own.

1

. Hand wash a small amount of clothes at home.

Take a bucket and a small amount of bleach or laundry detergent and let a couple of items sit for an hour or so. Then hand them up in the bathroom. This works best with T-shirts and undies but probably not as well for jeans or jackets. Since I live in an apartment complex, it costs about $4 a load to do laundry so I'd prefer to do it at home while watching TV.

2. Ditch the alcohol (or ouch-a-hol for your budget)As a bar wench at a popular pizza and beer joint, I've noticed that people spend outrageous amounts of money on beer. For someone that has been fine for the last 20 years drinking tea and Coca Cola, the idea of downing 5 beers at a sitting seems glutenous and just gross (don't tell my customers that though, because the more they drink the higher the tip!). So for those on a budget, stick with an ice tea or at least try and drink only one beer and alternate with water. Your liver

and wallet will thank you.

3.

Make friends in low places I have a relationship with the cashier at the 7-11 across the street. Purely platonic I assure you,! I trade him books from my extensive library and he gives me free soda and often brownies and other small snacks. Over the last year I have calculated it so that I save about $500 (one free drink a day, plus an average of one treat a week, and one old Glamor magazine per month) . All that I had to do to save this was be friendly.

4.

Take advantage of cheap thrills in your area As a student I realize I have an advantage ove those out of the lovely world of academia, but on or near campus, there is a LOT to do, most of which doesn't cost much. Those out of college, if you saved your school ID (and you really should, many places offer student discounts but don't verify that you are a

current student...shhh). In my area, there is a cheapy movie theater, where the movies are a couple months out of date but if you missed them the first time then it works, I'm going to see Sex in the City for $3. There are museums and dance halls that are often free or very cheap, fun events around campus that offer music and free food, and plenty others.

5.

Take a relaxing vacation one evening About one block from my house, there is an amazing resort, Arizona Inn. Completely innocuous from the outside, heavenly inside. I've done this a couple times and if you have a bit of panache then you can too. Just wear something great looking and stroll through the lobby, looking like you know where you are going. Walk past the restaurants and the gardens till you reach the pool. Find a lovely spot with enough shade, get a glass of water and pull out a magazine. When you get bored jump in the pool and flirt with the pool attendants. Then for a treat, order a strawberry daiquiri (or insert your favorite drink, something tropical), if they ask for your room number pull something out of your bum, and make sure to pay in cash. Sometimes resorts will have free socials at night, my little bit of paradise has an ice cream social every night, so I make sure to indulge a bit. When this gets dull then head off to the ladies room and shower, take a steam and nick a couple fancy lotions. When you are about to leave, ask normally. Maybe talk to the concierge about local attractions, take a brochure and stroll out. You have had a fabulous mini-vacation for the price of a drink and a nice tip for the pool attendant. Ta!

6.

Use amazon or ebay to buy small suppliesMy name is Julie and I have an internet shopping addiction. I love ebay and amazon, I literately get a rush of euphoria when I buy or bid on something cheap (until I get the bill of course). But these sites can be a great option if you don't go overboard. For instance, I inherited (from the lost and found box) an ipod mini. It works fabulously and it is my large ones back-up in case it breaks (which I do often, sigh) or it runs out of batteries. The only problem was that I didn't have a charger. 10 minutes on ebay and I got one for $2, s&h included, whereas the store sold them for $30.I also recently bought a winter scarf, hat and gloves set so I don't have to go to Buffalo Exchange, for about $5. And earlier this year I bought a great Kate Spade black handbag for about $20. It's understated and has taken a lot of damage, so it was a great purchase. So if you know what you want, then online shopping can help you a lot financially, but don't stray off the path or you'll end up with 15 packages coming in everyday and a digitally bent credit card.

I hope my mini list has inspired something in your frugal side and who knows, maybe someday it will be Julie's 100 frugal tips.

Cheers

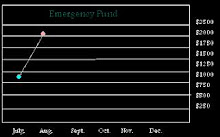

I did get a permanent schedule from my boss, I'll be working four days a week, including Friday and Saturday night which are the biggest money nights. I should be able to make my budget , provided I make $75 a night. Unfortunately since I missed a day this week, I probably won't make my budget, but hey fingers crossed.

I did get a permanent schedule from my boss, I'll be working four days a week, including Friday and Saturday night which are the biggest money nights. I should be able to make my budget , provided I make $75 a night. Unfortunately since I missed a day this week, I probably won't make my budget, but hey fingers crossed.